All Categories

Featured

Table of Contents

Level term life insurance policy is a policy that lasts a set term typically in between 10 and 30 years and features a level survivor benefit and degree costs that remain the very same for the entire time the policy holds. This indicates you'll understand exactly just how much your repayments are and when you'll have to make them, enabling you to budget as necessary.

Level term can be an excellent choice if you're wanting to buy life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance coverage Measure Research, 30% of all adults in the U.S. need life insurance coverage and do not have any type of policy. Degree term life is predictable and inexpensive, that makes it among the most preferred sorts of life insurance policy.

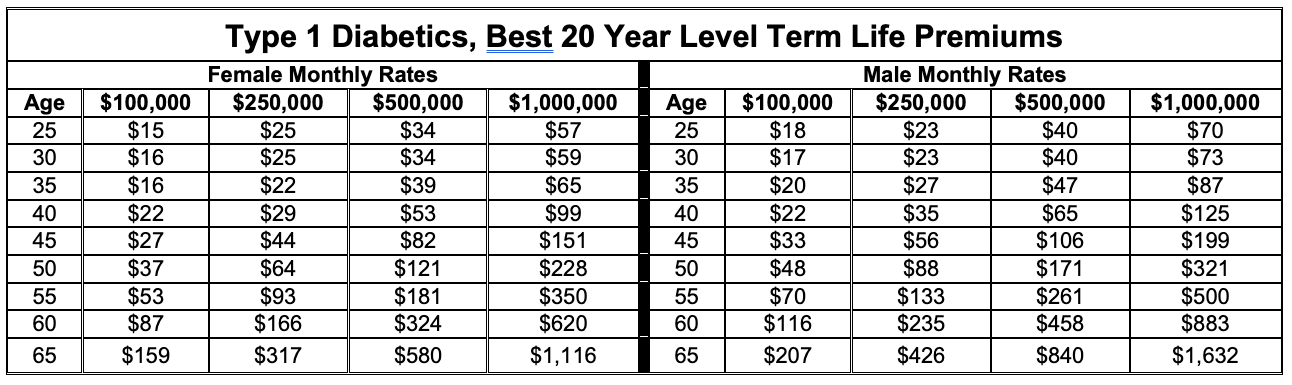

A 30-year-old man with a similar profile can anticipate to pay $29 monthly for the exact same insurance coverage. AgeGender$250,000 insurance coverage quantity$500,000 insurance coverage amount$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Ordinary regular monthly prices are calculated for male and women non-smokers in a Preferred wellness category getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

Prices might vary by insurer, term, protection quantity, health and wellness class, and state. Not all policies are readily available in all states. It's the cheapest kind of life insurance for a lot of people.

It enables you to budget and strategy for the future. You can quickly factor your life insurance policy right into your spending plan due to the fact that the premiums never alter. You can plan for the future simply as easily because you recognize exactly just how much money your loved ones will receive in the occasion of your absence.

The Benefits of Choosing Term Life Insurance With Level Premiums

In these situations, you'll typically have to go through a brand-new application procedure to get a better price. If you still need coverage by the time your level term life plan nears the expiration day, you have a few alternatives.

A lot of level term life insurance plans come with the alternative to restore protection on an annual basis after the initial term ends. The price of your plan will be based on your present age and it'll enhance every year. This might be a great option if you just require to extend your protection for one or 2 years or else, it can get pricey rather quickly.

Level term life insurance policy is one of the cheapest protection choices on the marketplace due to the fact that it supplies standard protection in the form of fatality benefit and only lasts for a set amount of time. At the end of the term, it runs out. Whole life insurance policy, on the other hand, is substantially a lot more costly than level term life since it doesn't end and includes a cash worth function.

Prices may vary by insurance firm, term, insurance coverage quantity, health class, and state. Not all plans are available in all states. Rate picture legitimate since 10/01/2024. Level term is a fantastic life insurance policy option for the majority of people, yet relying on your protection needs and individual situation, it might not be the very best suitable for you.

Annual sustainable term life insurance policy has a regard to just one year and can be renewed yearly. Yearly renewable term life costs are initially lower than level term life costs, yet prices go up each time you renew. This can be a good option if you, as an example, have simply give up smoking cigarettes and require to wait 2 or three years to request a level term policy and be qualified for a reduced price.

With a decreasing term life policy, your death benefit payment will certainly decrease gradually, but your payments will certainly remain the very same. Reducing term life plans like home loan defense insurance generally pay out to your lending institution, so if you're looking for a plan that will certainly pay to your liked ones, this is not a great suitable for you.

What Does Direct Term Life Insurance Meaning Provide?

Raising term life insurance coverage plans can help you hedge versus inflation or strategy economically for future youngsters. On the various other hand, you'll pay more ahead of time for much less protection with an enhancing term life plan than with a level term life plan. Level premium term life insurance policies. If you're uncertain which kind of plan is best for you, functioning with an independent broker can help.

Once you've chosen that degree term is ideal for you, the following action is to purchase your policy. Here's how to do it. Compute just how much life insurance policy you require Your coverage amount ought to offer for your family's long-term monetary needs, including the loss of your earnings in case of your death, as well as financial debts and daily expenses.

The most prominent type is now 20-year term. A lot of business will not sell term insurance coverage to a candidate for a term that finishes previous his or her 80th birthday celebration. If a plan is "eco-friendly," that implies it continues effective for an additional term or terms, approximately a specified age, also if the health and wellness of the insured (or other elements) would certainly cause him or her to be rejected if she or he requested a new life insurance policy policy.

So, costs for 5-year renewable term can be degree for 5 years, after that to a new price reflecting the new age of the guaranteed, and so on every 5 years. Some longer term policies will certainly assure that the premium will certainly not raise during the term; others do not make that guarantee, allowing the insurance policy business to increase the rate during the plan's term.

What is Level Term Life Insurance? Your Essential Questions Answered?

This means that the plan's owner can transform it right into a permanent sort of life insurance policy without additional evidence of insurability. In a lot of sorts of term insurance, consisting of house owners and vehicle insurance coverage, if you have not had an insurance claim under the plan by the time it runs out, you get no refund of the premium.

Some term life insurance coverage consumers have been miserable at this result, so some insurance firms have created term life with a "return of costs" feature. The premiums for the insurance with this feature are often dramatically greater than for plans without it, and they generally require that you maintain the plan in force to its term or else you waive the return of costs advantage.

Degree term life insurance policy costs and fatality advantages stay constant throughout the plan term. Level term policies can last for periods such as 10, 15, 20 or 30 years. Degree term life insurance is normally more affordable as it does not build money value. Degree term life insurance is just one of one of the most usual kinds of protection.

While the names typically are made use of mutually, level term insurance coverage has some essential distinctions: the costs and death benefit remain the very same for the period of insurance coverage. Level term is a life insurance policy policy where the life insurance policy premium and survivor benefit stay the exact same for the period of coverage.

Latest Posts

Best Final Expense Insurance Companies To Sell For

Burial Plans Insurance

Final Expense Insurance Usa